Car insurance quotes Anderson SC are crucial for securing the best possible coverage at competitive rates. Understanding the local market, common factors influencing premiums, and available coverage options is key to making informed decisions. This comprehensive guide explores the landscape of car insurance in Anderson, SC, helping you find the perfect policy.

Navigating the complexities of car insurance can be daunting. This resource simplifies the process, offering insights into finding quotes, analyzing coverage options, and strategies for saving money. Whether you’re a new driver or an experienced one, this guide provides valuable information to ensure you’re well-protected on the roads of Anderson, SC.

Understanding Car Insurance in Anderson, SC

Navigating the car insurance landscape in Anderson, SC, can feel complex. However, understanding the factors influencing rates and coverage options empowers you to make informed decisions. This section provides a comprehensive overview of the car insurance market in Anderson, SC, to help you understand your choices.The car insurance market in Anderson, SC, is similar to other markets in the state, with several providers vying for customers.

Competition influences pricing and available coverage options. Understanding the dynamics allows you to evaluate offers strategically.

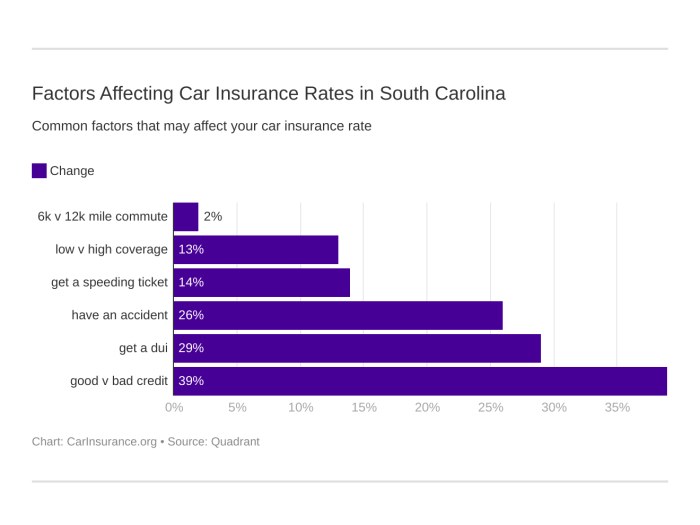

Factors Affecting Car Insurance Rates in Anderson, SC

Various factors contribute to the cost of car insurance in Anderson, SC. Each factor plays a role in calculating the premium, so understanding them is essential for managing your costs.

- Driving History and Accident Records: A clean driving record is crucial. Accidents and traffic violations directly impact premiums. A history of accidents or frequent violations leads to higher premiums, as it indicates a higher risk of future claims. For example, a driver with a recent speeding ticket might expect a noticeable increase in their premium compared to a driver with no recent violations.

- Vehicle Type and Model: The type and model of your vehicle play a significant role. Sports cars, high-performance vehicles, and older vehicles, in some cases, may have higher premiums due to perceived risk of damage or theft. The value of the vehicle is also a consideration.

- Anderson, SC’s Driving Conditions: Driving conditions in Anderson, SC, such as the frequency of accidents in specific areas, or high-traffic intersections, can influence insurance rates. The city’s layout and traffic patterns, along with any local driving habits, are factored into the calculation.

- Coverage Options: Different levels of coverage, including liability, collision, and comprehensive, affect the price. Choosing a higher level of coverage often translates to a higher premium.

- Age and Location: Age and location are key factors. Younger drivers and those living in areas with a higher concentration of accidents often have higher premiums.

Common Types of Car Insurance Coverage in Anderson, SC

Understanding the various types of coverage available is essential for choosing the right policy. This knowledge allows you to tailor your coverage to your specific needs and budget.

- Liability Coverage: This covers damages you cause to other people or their property in an accident. It’s typically a mandatory minimum requirement.

- Collision Coverage: This protects your vehicle if it’s damaged in an accident, regardless of who’s at fault. It’s beneficial in case of an accident where you are at fault.

- Comprehensive Coverage: This protects your vehicle against damages from events other than accidents, such as vandalism, theft, or weather-related damage.

Role of Driving History and Accident Records in Anderson, SC Car Insurance Premiums

A clean driving record is a major factor in determining your insurance premium. Driving history, including accidents and violations, significantly impacts your rates. A history of safe driving translates to lower premiums, while accidents and violations increase premiums.

Impact of Vehicle Type and Model on Anderson, SC Car Insurance Rates

The type and model of your vehicle influence your insurance rates. Factors such as the vehicle’s value, its potential for damage, and its risk of theft affect the premiums. For instance, high-performance vehicles often have higher premiums compared to more standard models.

Influence of Anderson, SC’s Specific Driving Conditions on Insurance Costs

Anderson, SC’s specific driving conditions, such as traffic patterns and accident frequency in certain areas, play a role in calculating insurance rates. High-accident areas tend to have higher premiums. The overall driving conditions in the city contribute to the risk assessment, and that is reflected in the insurance rates.

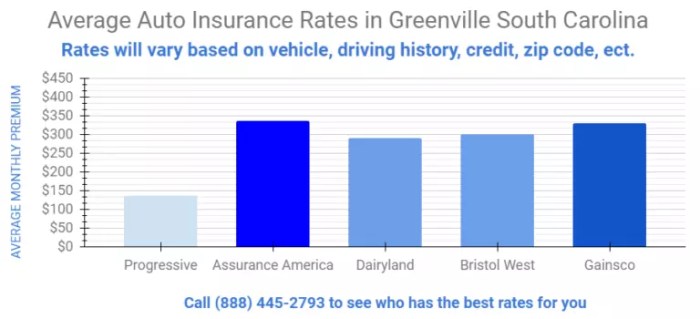

Comparison of Insurance Providers in Anderson, SC

This table provides a general comparison of insurance providers in Anderson, SC. Average rates vary, and this table is not exhaustive.

| Company Name | Coverage Options | Average Rates |

|---|---|---|

| Company A | Liability, Collision, Comprehensive | $1,200-$1,500 annually |

| Company B | Liability, Collision, Comprehensive, Uninsured Motorist | $1,300-$1,600 annually |

| Company C | Liability, Collision, Comprehensive, Roadside Assistance | $1,400-$1,700 annually |

Finding Quotes in Anderson, SC

Securing the most suitable car insurance in Anderson, SC involves a thoughtful approach. Understanding the available options and the factors influencing pricing is crucial for making informed decisions. A proactive and organized search process can lead to substantial savings and peace of mind.Navigating the world of car insurance quotes can feel overwhelming. However, a structured approach, incorporating various methods and a thorough understanding of your needs, can empower you to find the best coverage at a competitive price.

Cari asuransi mobil di Anderson, SC? Jangan asal pilih, bro! Mendingan cek dulu, nih, harga-harga yang ada. Tapi, kalo masalah kaki sakit, jangan lupa ke dr steven lemberger podiatrist and foot surgeon , orangnya ahli banget. Pasti bakal cepet sembuh. Pokoknya, cari yang terbaik buat mobil sama kaki lu! Jangan sampai salah pilih, bisa rugi banget, car insurance quotes Anderson SC.

Methods for Obtaining Quotes

A variety of methods exist for obtaining car insurance quotes in Anderson, SC. Employing a blend of online and offline resources can yield the most comprehensive results.

| Method | Description |

|---|---|

| Online Comparison Tools | Websites aggregating quotes from multiple insurers. |

| Insurance Agents (Offline) | Local agents offering personalized guidance and in-person consultations. |

| Direct Contact with Insurers | Visiting insurer websites or contacting them directly. |

| Referral Networks | Utilizing networks that connect you with insurance providers. |

Essential Information for Quotes

Accurate quotes necessitate providing specific details about your vehicle and driving history. This ensures that the premiums accurately reflect your risk profile.

- Vehicle Information: Make, model, year, and vehicle identification number (VIN) are essential.

- Driver Information: Age, driving history (including accidents and violations), and driving habits.

- Coverage Preferences: Desired coverage limits (liability, collision, comprehensive), and deductibles.

- Location: Your address in Anderson, SC.

- Usage of Vehicle: Daily commute versus recreational use significantly impacts pricing.

Reputable Insurance Providers

Numerous reputable insurance providers operate in Anderson, SC. Choosing a company with a strong track record and positive customer reviews is crucial.

- State Farm: A widely recognized and trusted insurance provider with a substantial presence in Anderson, SC.

- Geico: A popular choice known for its online accessibility and competitive pricing.

- Progressive: Another prominent insurance provider frequently offering discounts and competitive rates.

- Allstate: A major insurer with a comprehensive range of products and services available in Anderson, SC.

- Nationwide: Offers a variety of options, including specialized coverage, for specific situations.

Online vs. In-Person Quotes

Online and in-person quote processes differ significantly. Online tools are generally faster and more convenient, while in-person consultations provide personalized guidance.

- Online: Rapid, self-service approach. Provides a broad overview of options and prices, but may lack personalized assistance.

- In-Person: Personalized, in-depth consultations with local agents. Provides tailored recommendations and explanations. More time-consuming but offers greater clarity and understanding.

Using Online Comparison Tools

Online comparison tools simplify the process of gathering multiple quotes. These tools facilitate a direct comparison of various insurers.

- Select Coverage Type: Choose the types of coverage you need, like liability, collision, or comprehensive.

- Enter Vehicle Details: Provide the required information about your car.

- Input Driver Information: Enter your age, driving record, and other pertinent details.

- Review Quotes: Carefully compare the quotes received from different companies, considering factors like coverage and price.

Finding Local Agents

Local insurance agents offer valuable insight into Anderson, SC-specific policies and regulations. This can significantly influence your choice.

- Online Search: Utilize online search engines to find local agents in Anderson, SC.

- Community Directories: Consult local business directories to identify insurance agents.

- Referrals: Seek recommendations from friends, family, or colleagues who have used local insurance agents.

Finding Discounts

Several discounts can reduce your car insurance premiums. Taking advantage of available discounts can result in substantial savings.

- Discounts for Safe Driving: Companies often provide discounts to drivers with clean records or participation in defensive driving courses.

- Discounts for Bundling: Combining car insurance with other insurance products, such as home insurance, can yield substantial savings.

- Discounts for Students and Seniors: Insurers often provide discounts for student drivers or senior citizens.

- Discounts for Safety Features: Cars equipped with advanced safety features can qualify for discounts.

Common Car Insurance Discounts

| Discount Type | Eligibility Criteria | Estimated Savings |

|---|---|---|

| Safe Driving | Clean driving record, defensive driving course completion | 5-15% |

| Multi-Policy | Bundling car insurance with other policies (home, life, etc.) | 5-10% |

| Student/Senior | Student or senior driver | 3-8% |

| Safety Features | Vehicle equipped with anti-theft devices, airbags | 2-10% |

Analyzing Coverage Options

Understanding your car insurance coverage is crucial for financial security and peace of mind. Choosing the right coverage options aligns your protection with your needs and budget. This process involves a careful evaluation of various factors, including potential risks, driving habits, and financial circumstances.The different types of coverage available in Anderson, SC, provide varying levels of protection against potential losses.

Understanding these options allows you to make informed decisions that best suit your specific circumstances. Careful consideration of liability, comprehensive, collision, and uninsured/underinsured motorist coverage is essential to develop a comprehensive strategy.

Key Coverage Components

Car insurance policies in Anderson, SC, typically include liability coverage, which protects you from financial responsibility if you cause an accident and injure another person or damage their property. This coverage is mandated by law in most states, and the minimum requirements are Artikeld by the state. Other critical components often included are comprehensive and collision coverage. These address damage to your vehicle from perils like weather, vandalism, or accidents.

Understanding these core components is fundamental to making an informed choice about your insurance.

Levels of Liability Coverage

Liability coverage comes in various levels, reflecting different degrees of financial protection. Bodily injury liability coverage compensates victims of accidents caused by the insured. Property damage liability coverage addresses the cost of damage to another person’s property. Each level dictates the maximum amount of compensation the insurer will pay for damages.

Importance of Comprehensive and Collision Coverage

Comprehensive and collision coverage are crucial additions to your policy. Comprehensive coverage protects against incidents beyond your control, such as theft, fire, vandalism, or hail damage. Collision coverage addresses damage to your vehicle caused by an accident, regardless of who is at fault. These coverages are essential for replacing or repairing your car after unexpected events. They provide a safety net, mitigating financial strain in unforeseen circumstances.

Comparing Costs and Benefits of Coverage Options, Car insurance quotes anderson sc

The cost of car insurance varies based on the chosen coverage levels. Higher coverage levels usually come with a higher premium. However, the benefits of increased coverage can provide significant financial protection in the event of an accident. Carefully weigh the cost and benefits of each option to create a plan that aligns with your financial situation and risk tolerance.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is vital. It provides protection if you are involved in an accident with a driver who does not have adequate insurance or no insurance at all. This coverage steps in to compensate you for your injuries and property damage, safeguarding your financial well-being in these critical situations.

Coverage Variations Based on Driving History

Driving history significantly impacts car insurance premiums. A clean driving record typically results in lower premiums, whereas accidents or traffic violations can lead to higher premiums. This is because insurers assess risk based on past driving behavior. Insurance companies use driving records to evaluate and adjust premiums accordingly.

Potential Costs of Various Coverage Options

| Coverage Type | Description | Estimated Cost (Anderson, SC – Example) |

|---|---|---|

| Liability Only (Minimum) | Covers injuries and property damage caused by the insured. | $100-$500/year |

| Liability + Comprehensive | Covers liability and damage to your car from events like theft or weather. | $200-$800/year |

| Full Coverage (Liability + Comprehensive + Collision) | Covers all potential damages, including liability, vehicle damage, and events like theft or vandalism. | $300-$1200/year |

Note: These are example costs and may vary based on individual factors. Consult with an insurance provider for personalized quotes.

Factors Influencing Premiums

Understanding the factors that influence your car insurance premiums in Anderson, SC is crucial for making informed decisions. This knowledge empowers you to proactively manage your costs and potentially secure more favorable rates. Insurance companies use a variety of criteria to assess risk and calculate premiums.

Key Factors Impacting Car Insurance Premiums

Insurance premiums are not a fixed amount; they are calculated based on a variety of factors. Understanding these factors is key to comprehending how your personal circumstances might affect your insurance cost.

| Factor | Explanation | Impact on Rates |

|---|---|---|

| Driving Record | This encompasses accidents, violations, and the overall history of your driving. | A clean driving record typically results in lower premiums, while a history of accidents or violations will increase them significantly. |

| Vehicle Type | The make, model, and year of your vehicle play a significant role. Certain vehicles are more prone to theft or damage. | High-performance vehicles or those with a history of theft or damage may have higher premiums. Conversely, a vehicle perceived as less risky may result in lower premiums. |

| Credit Score | Your creditworthiness, as indicated by your credit score, influences insurance rates. | A lower credit score often correlates with higher premiums, reflecting an increased perceived risk of non-payment. |

| Age and Gender | Demographic factors, including age and gender, are considered in the risk assessment. | Younger drivers and male drivers are often considered higher risk and may face higher premiums. However, this is not a universal rule. |

| Location | Your residence in Anderson, SC, and other factors specific to your area (e.g., crime rates) can affect your rates. | Areas with higher crime rates or specific traffic hazards in Anderson, SC may lead to higher insurance premiums. |

Impact of Credit Score on Car Insurance Rates

A lower credit score often translates to a higher car insurance premium. Insurance companies use credit scores as an indicator of financial responsibility. The rationale is that individuals with a history of difficulty managing debt may be more likely to have trouble paying their insurance premiums. For instance, if someone has a history of late payments or defaults, the insurance company might perceive a higher risk of not receiving the payment when due.

This is a common practice across various insurance sectors. Examples include auto, homeowners, and renters insurance.

Driving History Impact on Car Insurance Rates

A driver’s history, including accidents and violations, significantly impacts premiums. Accidents, especially those involving severe injuries or property damage, increase the risk assessment. Traffic violations, such as speeding tickets or reckless driving, signal a propensity for risky driving behavior, which insurance companies view as a greater risk. Consequently, these factors typically lead to higher premiums.

Vehicle Type and Car Insurance Costs

The type of vehicle significantly influences car insurance costs. High-performance sports cars, luxury vehicles, and older vehicles with a high risk of theft or damage often result in higher premiums. Conversely, vehicles deemed safer and less susceptible to damage or theft may have lower premiums. Insurance companies evaluate the vehicle’s safety features, repair costs, and market value when determining premiums.

Cari quote asuransi mobil di Anderson, SC? Jangan kebingungan, bro! Cari tahu dulu nomor telepon Everest Denali Insurance Company, everest denali insurance company phone number , biar bisa tanya-tanya dulu. Pasti ada diskon gede-gedean, kan? Pokoknya, jangan sampe salah pilih asuransi mobil, nanti rugi! Cari yang terbaik buat kantong, ya!

Anderson, SC’s Safety Regulations and Insurance Premiums

Anderson, SC’s specific safety regulations, like those regarding speed limits, seatbelt use, and distracted driving, play a role in determining premiums. Compliance with these regulations indicates a lower risk of accidents, leading to lower premiums. Conversely, a history of non-compliance with safety regulations can result in higher premiums.

Age and Gender in Car Insurance Premiums

Insurance companies often consider age and gender when assessing risk. Younger drivers are often viewed as a higher risk due to a greater likelihood of accidents. Insurance companies analyze accident statistics for different age groups and adjust premiums accordingly. While gender may be a factor, it is often less influential than age in determining rates. This approach is based on statistical analysis of historical data relating to accidents and driving behavior.

Typical Discounts and Incentives

Insurance providers frequently offer discounts for safe driving habits, vehicle safety features, or accident-free driving records. Specific discounts available in Anderson, SC may vary among insurers. Examples include good student discounts, anti-theft devices, or accident-free driving programs.

Tips for Saving Money: Car Insurance Quotes Anderson Sc

Taking control of your car insurance premiums in Anderson, SC can feel overwhelming. However, with a proactive approach and understanding of the factors influencing your rates, you can achieve significant savings. This section provides practical strategies for reducing your car insurance costs while maintaining responsible coverage.Understanding the factors impacting your insurance rates allows you to make informed decisions about how to lower your premiums.

By identifying areas where you can optimize your coverage and driving habits, you can gain control over your financial burden. The following sections Artikel actionable steps to achieve these savings.

Safe Driving Habits for Lower Rates

Safe driving habits are crucial for lowering car insurance premiums. Consistent adherence to traffic laws and responsible driving practices directly influence your insurance provider’s assessment of your risk profile. This, in turn, can lead to substantial cost reductions. Examples of safe driving habits include maintaining a safe following distance, avoiding aggressive driving maneuvers, and adhering to speed limits.

These actions demonstrate your commitment to safety, which insurers value.

Bundling Insurance for Savings

Bundling car insurance with other insurance products, such as homeowners or renters insurance, can often lead to significant discounts. This is because insurers often offer bundled discounts to reward customers for their loyalty and demonstrate a commitment to comprehensive protection. This approach can provide a synergistic effect, allowing you to consolidate your insurance needs and save money across multiple policies.

For instance, combining your car insurance with home insurance can result in a combined discount.

Increasing Deductibles to Reduce Premiums

Increasing your deductible is a straightforward way to reduce your car insurance premiums. A higher deductible means you’re assuming a greater financial responsibility in the event of an accident or damage. Insurers recognize this and compensate by offering lower premiums. For example, raising your deductible from $500 to $1000 can lead to a notable reduction in your monthly payments.

However, be sure to carefully consider your financial capacity to absorb potential costs before making this change.

Comparing Insurance Providers and Prices

Thorough comparison shopping is essential to finding the best rates in Anderson, SC. Insurance providers in Anderson, SC offer diverse rates and coverage options. Comparing these options is crucial to identify the best fit for your needs and budget. A systematic approach is needed to evaluate and compare insurance providers. This table provides a structured framework for this process.

| Insurance Provider | Coverage Options | Premiums | Discounts |

|---|---|---|---|

| Company A | Comprehensive, Collision, Liability | $150/month | Bundled, Multi-car |

| Company B | Comprehensive, Collision, Liability | $125/month | Safe Driver, Good Student |

| Company C | Comprehensive, Collision, Liability | $175/month | None |

Utilizing Discounts to Reduce Premiums

Insurance companies often offer discounts for various factors. Taking advantage of these discounts can significantly reduce your premiums. These discounts can include safe driver discounts, multi-vehicle discounts, and anti-theft device discounts. For instance, a safe driver discount can reduce your premium by 10-20% if you have a clean driving record. Carefully review the specific discounts offered by different insurance providers in Anderson, SC to determine how you can benefit.

Shopping Around for Better Rates

Thoroughly researching and comparing quotes from multiple insurance providers is crucial for securing the best possible rates. This involves contacting various insurance companies in Anderson, SC and obtaining quotes based on your specific needs and coverage requirements. Online comparison tools can streamline this process, allowing you to easily compare quotes from different providers and identify the most affordable option.

By actively seeking quotes from various providers, you can gain control over your premiums and ensure you are receiving the most competitive rates available.

Closing Summary

In conclusion, securing the right car insurance quotes Anderson SC involves understanding the local market, comparing quotes, analyzing coverage options, and implementing cost-saving strategies. By following the tips and insights presented in this guide, you can confidently choose a policy that meets your needs and budget, ensuring peace of mind on the roads of Anderson, SC.

Common Queries

What are the typical factors that affect car insurance rates in Anderson, SC?

Several factors influence car insurance rates in Anderson, SC, including driving history, vehicle type, and local driving conditions. Age, gender, and credit score can also play a role.

What are some common car insurance discounts available in Anderson, SC?

Many insurance providers offer discounts for safe driving, bundling policies, and good student driver programs. Check with individual providers for specific discounts and eligibility requirements.

How do I compare car insurance quotes online in Anderson, SC?

Online comparison tools allow you to input your vehicle information and driving history to receive quotes from multiple providers. This streamlined approach lets you easily compare prices and coverage options.

What is the difference between liability, comprehensive, and collision coverage?

Liability coverage protects you from damages you cause to others. Comprehensive coverage protects against damage to your vehicle from events not related to an accident (like vandalism or weather). Collision coverage protects against damage to your vehicle in an accident, regardless of who is at fault.