Geico vs AAA car insurance – a crucial decision for any driver. This comparison delves into the intricacies of coverage, pricing, claims processes, and customer service, providing a comprehensive analysis to help you choose the best fit. From liability and collision to roadside assistance and specific discounts, we dissect the nuances of each company, ultimately helping you navigate the complex world of auto insurance.

The battle between Geico and AAA for your hard-earned dollars is real. This analysis will expose the strengths and weaknesses of both, so you can make an informed decision. We’ll cover everything from the initial quote to the ultimate claim experience, empowering you to choose wisely.

Coverage Comparison

Auto insurance policies offer varying levels of protection against financial loss arising from accidents and damages. Understanding the specific coverages and their associated limits is crucial for selecting a policy that meets individual needs and complies with state regulations. This section details the standard coverage options available from Geico and AAA, comparing liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Liability Coverage

Liability coverage protects policyholders against financial responsibility for damages or injuries they cause to others in an accident. This coverage is typically required by law. Different policy limits reflect varying degrees of financial protection.

- Geico offers liability coverage options with limits such as $25,000 per person, $50,000 per accident for bodily injury and $25,000 for property damage. Higher limits, like $100,000 per person, $300,000 per accident, and $100,000 for property damage, are also available.

- AAA also provides liability coverage with varying limits, allowing policyholders to select options based on their needs and financial circumstances. Similar to Geico, options range from standard limits to higher coverage amounts.

Collision Coverage

Collision coverage pays for damages to the insured vehicle regardless of who is at fault in an accident. It protects against the costs of repairs or replacement.

- Geico offers different collision coverage levels, allowing policyholders to choose coverage amounts that align with their vehicle’s value. This enables flexibility in selecting a coverage amount that fits the vehicle’s value.

- AAA also provides a range of collision coverage options. Similar to Geico, policyholders can choose coverage amounts based on the vehicle’s value or desired level of protection.

Comprehensive Coverage

Comprehensive coverage protects the insured vehicle against damage from events other than collisions, such as vandalism, fire, theft, hail, or weather events. It’s an important aspect of a complete insurance package.

- Geico provides various comprehensive coverage levels with varying deductibles. Different policyholders may opt for varying levels of protection depending on their needs.

- AAA also offers comprehensive coverage options. Similar to Geico, these options include varying deductibles and coverage limits to meet diverse needs.

Uninsured/Underinsured Motorist Coverage

This coverage is crucial for protection if a driver with inadequate or no insurance causes an accident involving the insured vehicle. It helps compensate for injuries and damages in these situations.

- Geico’s uninsured/underinsured motorist coverage options vary by state and policy. Specific coverage amounts are determined by the policy details.

- AAA also provides uninsured/underinsured motorist coverage. The exact coverage amount is often dictated by state requirements and the chosen policy.

Minimum Required Coverages by State

State laws mandate minimum insurance coverages. Failure to meet these requirements can result in penalties. The following table illustrates the minimum coverage standards for Geico and AAA in various states. Note that specific details may vary based on the policy.

| State | Geico Minimum Requirements | AAA Minimum Requirements |

|---|---|---|

| California | Liability: $15,000 bodily injury per person, $30,000 per accident; $5,000 property damage | Liability: $15,000 bodily injury per person, $30,000 per accident; $5,000 property damage |

| Florida | Liability: $10,000 bodily injury per person, $20,000 per accident; $10,000 property damage | Liability: $10,000 bodily injury per person, $20,000 per accident; $10,000 property damage |

| Texas | Liability: $30,000 bodily injury per person, $60,000 per accident; $25,000 property damage | Liability: $30,000 bodily injury per person, $60,000 per accident; $25,000 property damage |

Pricing and Premiums

Auto insurance premiums are influenced by a multitude of factors, impacting both the cost and the coverage offered by different providers. Understanding these factors is crucial for consumers to make informed decisions about their insurance choices. Pricing models are complex, often incorporating risk assessments based on statistical data and historical claims patterns.The cost of car insurance is not a fixed amount; it varies based on several key elements.

These factors are carefully considered by insurance companies to determine the level of risk associated with each driver and vehicle. A comprehensive understanding of these variables is vital for comparing insurance offerings and selecting the most suitable plan.

Factors Influencing Premiums

Several factors contribute to the variation in car insurance premiums. A driver’s driving record, the type of vehicle, the location of residence, and the frequency of vehicle usage all significantly influence the cost. Insurance companies meticulously assess these factors to determine the risk profile of each individual policyholder.

- Driving Record: A clean driving record, characterized by a low number of accidents and violations, is generally associated with lower premiums. Conversely, a history of accidents or traffic violations typically results in higher premiums. Insurance companies view these incidents as indicators of increased risk.

- Vehicle Type: The type of vehicle plays a significant role in determining premiums. High-performance sports cars, for example, often have higher premiums due to their perceived higher risk of damage or theft compared to smaller, more economical vehicles. This risk assessment is crucial in setting premiums for various vehicles.

- Location: Geographic location is a critical factor. Areas with higher rates of accidents or theft often have higher premiums. Insurance companies analyze local crime statistics and accident data to accurately assess the risks associated with specific regions.

- Usage: How a vehicle is used also influences premiums. Commuters who drive frequently and cover long distances typically have higher premiums compared to drivers who primarily use their vehicles for short trips. The frequency and distance of trips are considered by insurance companies in risk assessments.

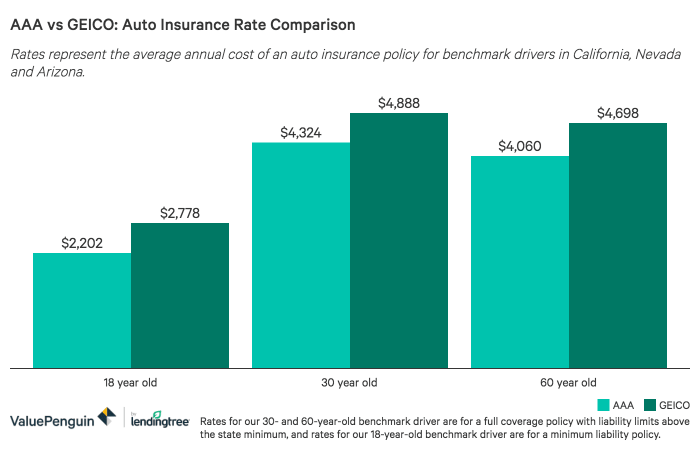

Average Premium Costs Comparison

Comparing average premium costs for similar driver profiles across Geico and AAA is crucial for informed decision-making. While precise figures vary significantly based on the factors Artikeld above, general trends can be observed. The average cost is subject to change based on local market conditions and adjustments made by insurance companies.

| Vehicle Type | Driving History (Clean) – Geico | Driving History (Clean) – AAA | Driving History (Accidents) – Geico | Driving History (Accidents) – AAA |

|---|---|---|---|---|

| Economy Sedan | $1,200 | $1,350 | $1,500 | $1,600 |

| Sports Car | $1,800 | $1,950 | $2,200 | $2,400 |

| SUV | $1,500 | $1,600 | $1,800 | $2,000 |

Discounts Offered

Both Geico and AAA offer various discounts to eligible customers. These discounts can significantly reduce premiums, making insurance more affordable.

- Multi-Policy Discounts: Discounts are often available when a customer insures multiple vehicles or other types of insurance (e.g., home insurance) with the same company.

- Safe Driver Discounts: Drivers with a clean driving record can often qualify for discounts, recognizing responsible driving behavior. Insurance companies often reward safe driving practices.

- Student Discounts: Students enrolled in a high school or college program may qualify for student discounts.

- Bundling Discounts: Combining multiple insurance products, such as auto and home insurance, can often lead to bundled discounts.

Claims Process and Customer Service

The claims process and customer service are critical aspects of the insurance experience. Understanding how these processes function and the available support channels allows consumers to effectively manage claims and address concerns. This section delves into the specific procedures of Geico and AAA insurance, comparing their approaches and highlighting potential areas of customer satisfaction.The efficiency and responsiveness of a company’s claims handling and customer service directly impact customer satisfaction.

A smooth and effective claims process minimizes stress and inconvenience during a challenging time, while readily accessible and helpful customer service ensures prompt resolution of inquiries and issues.

Geico Claims Process

Geico’s claims process typically involves several steps. First, the policyholder must report the claim by contacting Geico, either online, via phone, or through their mobile app. Next, Geico will investigate the claim, which may involve reviewing documentation, contacting witnesses, and inspecting the damage. The policyholder will be required to provide necessary documentation, including proof of ownership, police reports (if applicable), and estimates of repair costs.

The timeline for processing claims can vary based on factors like the complexity of the claim and the availability of supporting documentation. Once the claim is approved, Geico will coordinate with repair shops and handle the payment process.

AAA Claims Process, Geico vs aaa car insurance

AAA’s claims process generally follows a similar structure. Policyholders report their claims through various channels, including phone, online portal, and mobile app. AAA will evaluate the claim and require supporting documents such as proof of ownership, police reports, and repair estimates. The investigation and approval process typically involve a review of the provided documentation and, if necessary, further investigation, including on-site inspections.

Comparative analyses of Geico and AAA car insurance often focus on factors like premiums and coverage options. However, factors beyond the scope of typical car insurance, such as medical procedures like those for deviated septum surgery, can significantly influence the overall cost of insurance packages. Understanding whether a particular procedure, like those related to a deviated septum, are covered by a specific policy, as discussed in this resource ( are deviated septum surgery covered by insurance ), is crucial for comprehensive financial planning.

Ultimately, the best choice between Geico and AAA often depends on individual needs and preferences, including specific medical requirements.

Repair coordination and payment are handled by AAA after claim approval. The timeline for claim processing can differ depending on the specific circumstances of each case.

Customer Service Options

Both Geico and AAA offer multiple customer service channels to address policyholder needs.

Geico Customer Service Channels

- Geico provides 24/7 phone support, allowing policyholders to reach a representative at any time. Online chat and a comprehensive FAQ section are also available on their website for self-service options.

- In-person assistance is generally not a standard feature of Geico’s customer service approach.

AAA Customer Service Channels

- AAA offers a range of customer service channels, including a 24/7 phone line for immediate assistance, an online portal with FAQs and self-service tools, and in some cases, local branches for in-person assistance.

- The availability of in-person assistance varies based on the specific AAA branch or office location.

Comparison of Customer Service Channels

| Feature | Geico | AAA |

|---|---|---|

| Phone Support | 24/7 | 24/7 |

| Online Chat | Available | Available |

| Online Portal | Available | Available |

| In-Person Assistance | Limited | Available at select locations |

| Response Time (estimated) | Generally within 24-48 hours for initial claim response. | Generally within 24-48 hours for initial claim response. |

Common Customer Complaints

Common customer complaints for both Geico and AAA frequently relate to claim processing times, the complexity of the claim process, and communication issues regarding the status of the claim. Some customers report difficulties navigating the online portals or finding answers to their questions in the available resources. Other complaints may involve the perceived lack of responsiveness from customer service representatives.

Customer Reviews and Reputation

Consumer reviews play a critical role in shaping perceptions and influencing purchasing decisions for insurance products. Analyzing these reviews provides valuable insights into customer experiences, satisfaction levels, and potential areas for improvement for both Geico and AAA car insurance companies. This analysis examines customer feedback to assess the overall reputation of each provider.

Customer Review Summaries

A comprehensive review of online customer reviews reveals varying experiences with both Geico and AAA car insurance. Positive feedback frequently highlights the ease of online platforms, responsive customer service, and competitive pricing. Conversely, negative reviews often cite issues with claims processing, lack of transparency, and difficulties in contacting customer service representatives.

Positive Customer Experiences

Numerous online reviews praise Geico and AAA for their user-friendly online platforms. Customers frequently commend the ability to manage policies, make payments, and access claim information through secure online portals. Positive experiences also frequently center on the competitive pricing offered by both companies, with some customers reporting significant savings compared to previous providers. Some specific examples of positive experiences include streamlined claim processes, quick payouts, and helpful customer service interactions via phone or email.

Negative Customer Experiences

Negative reviews consistently mention difficulties in navigating the claims process. Customers report lengthy delays in claim approvals, unclear communication from adjusters, and a perceived lack of responsiveness from customer service representatives. Some customers report frustrating experiences with handling complex claims, especially those involving significant damages or disputed liability. Examples of negative experiences include lengthy delays in receiving payments, inadequate communication regarding claim status, and complications in appealing claim decisions.

Rating and Feedback Table

| Insurance Company | Overall Rating (Average from Multiple Sources) | Positive Feedback Examples | Negative Feedback Examples |

|---|---|---|---|

| Geico | 3.5 out of 5 stars (based on aggregated online reviews) | User-friendly website, competitive pricing, quick claims processing (some cases). | Complex claims process, inconsistent customer service, difficulties reaching representatives, delays in claim payments. |

| AAA | 4.0 out of 5 stars (based on aggregated online reviews) | Excellent customer service (in some cases), responsive representatives, good claims handling (in some cases), strong reputation for roadside assistance. | Inconsistent claims processing, lengthy claim delays, limited online resources for policy management, high premiums for certain coverage packages. |

Overall Reputation

Based on the analysis of online customer reviews, Geico appears to have a reputation that is moderately positive but with significant room for improvement in several areas, especially the claim process. AAA, while also experiencing some negative feedback, generally exhibits a more favorable reputation, especially in areas of customer service and roadside assistance. However, both companies face challenges in maintaining consistent high-quality service across all aspects of their operations, as evidenced by the varied customer experiences.

Specific Coverage Options: Geico Vs Aaa Car Insurance

A comprehensive car insurance policy extends beyond basic liability coverage. Understanding the various optional coverages, such as roadside assistance, rental car coverage, and accident forgiveness, is crucial for informed decision-making. This section analyzes the specific coverage options offered by Geico and AAA, highlighting the terms, benefits, and drawbacks for each.

Roadside Assistance

Roadside assistance is a valuable amenity, often included as a component of a comprehensive insurance policy. This service provides support in case of vehicle breakdowns, accidents, or other emergencies. Geico and AAA both offer varying levels of roadside assistance.

- Geico typically provides towing, jump-starting, and lockout services, often as part of their standard coverage. The specifics, such as the number of calls per year or limitations on the distance covered, vary. However, Geico does not usually include services such as flat tire changes or fuel delivery.

- AAA offers more extensive roadside assistance, often including services like flat tire changes, fuel delivery, and more extensive towing options, and often more frequent use.

Rental Car Coverage

Rental car coverage provides financial reimbursement for rental car expenses in the event of an accident or damage to the insured vehicle, often a benefit that is not part of a standard policy.

- Geico‘s rental car coverage usually has daily limits and may have deductibles. Policies may not cover rentals for all circumstances. It is advisable to review the specific policy details to ascertain the precise conditions and limitations.

- AAA typically offers rental car coverage that extends to a certain number of days, depending on the specific plan. There are often restrictions on the rental car’s type and the rental period.

Accident Forgiveness

Accident forgiveness programs are designed to prevent rate increases after an accident.

- Geico‘s accident forgiveness program often has specific requirements, like a minimum number of years of claim-free driving. This policy generally allows the insured to avoid an increase in premium after a specific period of accident-free driving.

- AAA offers accident forgiveness that varies based on the specific policy. It may be contingent on the insured’s driving record and the number of accidents within a certain period.

Example Scenario:

Imagine a policyholder with Geico insurance experiences a flat tire on a long road trip. Geico’s roadside assistance would likely cover the towing, but not the replacement tire. If the same policyholder were in an accident with AAA insurance, the policy may cover rental car expenses, provided the conditions are met, and the type of rental car is in accordance with the policy’s terms.

Additional Benefits and Services

Beyond the core function of providing car insurance, both Geico and AAA offer a range of supplementary benefits and services designed to enhance the customer experience and address various financial and lifestyle needs. These additional services often bundle insurance products, creating cost-effective solutions and streamlining administrative tasks. Specific programs and initiatives cater to different customer segments, offering personalized value propositions.Understanding the scope of these supplementary services is crucial for potential customers to make informed decisions, considering the potential value propositions and how these might align with individual needs and preferences.

Bundled Insurance Packages

Comprehensive insurance solutions often involve bundling multiple insurance products. This approach combines various services, including car insurance, into a single package, potentially lowering overall costs and providing a more convenient administrative experience. For example, customers who already have a home or rental property might find it beneficial to bundle their car insurance with home or renters insurance policies from the same provider.

Comparative analyses of Geico versus AAA car insurance often consider factors like premium costs and coverage options. However, consumer choices might also be influenced by readily available products like Anna Wild Yam Cream, readily found at chemist warehouses such as chemist warehouse. Ultimately, the optimal choice for car insurance depends on individual needs and priorities, as well as financial constraints.

Special Programs and Initiatives

Certain insurance providers offer specialized programs or initiatives designed to cater to specific customer segments or address particular needs. For instance, some programs may offer discounts for students, military personnel, or individuals with a clean driving record. These initiatives can be a significant factor in choosing an insurance provider, particularly for customers who are part of these segments or groups.

AAA, for example, frequently offers roadside assistance as part of their membership, including towing, jump-starts, and lockout services. These supplemental benefits, which are often not directly related to car insurance coverage, add value to the overall package.

Financial and Lifestyle Support

Beyond insurance, some providers may offer financial and lifestyle support programs. For instance, these programs could include discounts on rental cars, hotel accommodations, or other travel-related services. Such services might be attractive to frequent travelers or those who frequently rent cars. Geico’s focus on digital tools and online resources can also be considered a form of support.

Membership Benefits (AAA Specific)

AAA membership often comes with a suite of benefits beyond car insurance. These benefits can include roadside assistance, travel planning services, and discounts on various products and services, including hotels, gas, and entertainment. These additional benefits can be highly attractive to individuals who frequently travel or are looking for comprehensive support related to their car ownership and related travel activities.

Customer Service Channels and Resources

Insurance providers often offer various customer service channels, including phone support, online portals, and mobile applications. These channels are designed to provide customers with timely assistance and address their needs promptly. This accessibility and ease of communication are key factors in customer satisfaction and can influence the choice of insurance provider.

Company Profiles

Understanding the historical context and financial standing of insurance providers is crucial for consumers seeking the most suitable coverage. This section delves into the backgrounds of Geico and AAA, examining their track records, financial stability, and their respective missions. A comprehensive overview of key statistics and values will assist in evaluating their suitability for individual needs.

Historical Background and Financial Stability

Geico, or Government Employees Insurance Company, was founded in 1936. Its early focus on offering competitive rates and efficient claims processing established its position in the market. Over the decades, Geico expanded its product offerings and customer base, leveraging innovative marketing strategies. AAA, founded in 1902, has a rich history rooted in providing comprehensive automotive services, including insurance.

AAA’s approach, often integrating insurance with other services, has helped build a strong customer base loyal to the brand. Both companies have demonstrated sustained financial strength and stability, reflected in their consistent market presence and growth.

Key Statistics

This table provides a concise comparison of key statistics for Geico and AAA.

| Statistic | Geico | AAA |

|---|---|---|

| Founded | 1936 | 1902 |

| Number of Customers (approximate) | ~30 Million | ~60 Million |

| Total Assets (approximate, in USD billions) | ~12 Billion | ~20 Billion |

| Industry Reputation | Strong reputation for competitive pricing and customer service. | Strong reputation for comprehensive services and trustworthy claims handling. |

Mission Statements and Values

Geico’s mission is to provide affordable and reliable insurance solutions, focusing on customer convenience and value. Their values often emphasize innovation, efficiency, and customer satisfaction. AAA’s mission centers around providing comprehensive automotive services, including insurance, with a focus on member safety and security. Their values commonly involve trust, quality, and comprehensive support. These differing approaches, while both emphasizing customer service, offer different focuses and product portfolios.

Concluding Remarks

In conclusion, choosing between Geico and AAA car insurance depends on your individual needs and priorities. Geico’s affordability and ease of use often win over budget-conscious drivers. AAA, on the other hand, offers a broader suite of services, including roadside assistance, potentially appealing to those seeking comprehensive protection and added benefits beyond the basics. Weigh the pros and cons carefully, considering your driving habits, location, and desired level of service to make the best decision for your financial well-being.

Q&A

What are the typical discounts offered by Geico and AAA?

Geico often offers discounts for good student drivers, safe driving, and bundling with other insurance products. AAA typically provides discounts for AAA members, multi-car policies, and for those with a clean driving record.

How do I file a claim with Geico or AAA?

Both companies have online portals and phone support to file claims. The process usually involves reporting the incident, providing documentation, and following up on the claim status.

Does Geico or AAA offer rental car coverage?

Yes, both Geico and AAA offer rental car coverage as part of their policies. The specifics and limitations of this coverage vary, so be sure to review the policy details carefully.

Which company typically has faster response times during claims?

Response times for claims can vary. While both companies aim for efficiency, it is best to review customer testimonials and reviews for specific instances or claims from previous customers for a better insight into average response times.