How much is Rivian insurance cost? Figuring out your insurance premium for a Rivian is like trying to decipher ancient hieroglyphics—lots of factors are at play. From your driving record to the specific model, location, and even the optional add-ons, the price can vary wildly. This comprehensive guide unravels the mystery, providing you with all the essential information to navigate the world of Rivian insurance.

We’ll explore the key elements that impact Rivian insurance costs, from the different models to the claims process, and even offer smart tips for minimizing those premiums. Get ready to become an expert in Rivian insurance in no time.

Factors Influencing Rivian Insurance Costs

Rivian’s electric vehicles are totally different from your average gas-guzzlers, and that affects how much insurance costs. It’s not just about the car; factors like where you live, how you drive, and even the specific Rivian model all play a role in shaping your insurance bill. Understanding these variables is key to getting the best deal.Rivian insurance premiums are influenced by a complex interplay of factors, some of which are unique to EVs and some of which are common to all vehicles.

These factors include the vehicle’s value, safety features, and the driver’s history, just like with other cars. However, the electric powertrain and advanced technology in Rivian vehicles also add a layer of complexity.

Vehicle-Specific Factors

Rivian offers a range of models, each with its own unique features and price tags. This directly impacts insurance costs, as more expensive models often have higher premiums. The technology and safety features also play a significant role. For example, advanced driver-assistance systems (ADAS) like automatic emergency braking (AEB) and lane departure warnings can influence premiums favorably.

Rivian’s focus on safety features can result in lower insurance costs compared to similarly priced vehicles with fewer safety features.

Driver History and Habits

A driver’s history, including past accidents, traffic violations, and claims, significantly impacts insurance premiums for Rivian vehicles, just like with any other car. Driving habits, such as speeding, aggressive driving, and the frequency of driving, also affect insurance rates. For instance, a driver with a clean record and a history of safe driving habits will likely get a lower premium compared to a driver with a history of accidents or violations.

Furthermore, factors like the driver’s age and location also play a crucial role.

Location-Based Factors

Insurance costs vary significantly based on location. Areas with higher rates of accidents or theft, or areas with higher traffic density, will typically result in higher premiums for Rivian vehicles, similar to other types of vehicles. For example, urban areas with more congested roads and higher accident rates tend to have higher insurance costs. Insurance companies consider the local driving conditions and crime rates when determining premiums.

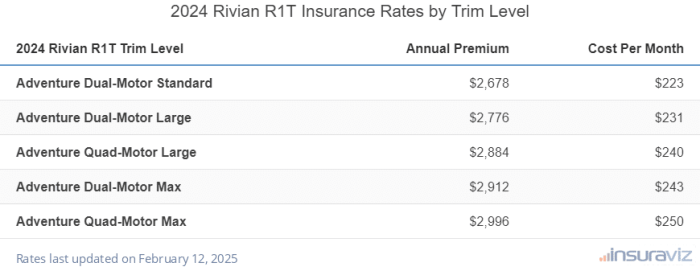

Comparison of Rivian Models and Insurance Costs

| Rivian Model | Estimated Insurance Cost (Illustrative Example – Actual Costs Vary Significantly) | Factors Influencing Cost |

|---|---|---|

| Rivian R1T | $1,500 – $2,500 annually | Higher value, advanced safety features, potential for off-roading |

| Rivian R1S | $1,300 – $2,200 annually | Similar value to R1T, potential for off-roading |

| Rivian EDV | $1,000 – $1,800 annually | Lower value, fewer advanced features, higher fuel efficiency |

Note: These are just illustrative examples. Actual insurance costs will depend on numerous factors specific to each driver and vehicle.

Insurance Coverage Options for Rivian Vehicles

Yo, peeps! Insurance for your Rivian ride ain’t just about the price, it’s about the coverage you get. Knowing what’s included and what you can add on is key to keeping your Rivian safe and sound. Different plans mean different levels of protection, so let’s break it down!Understanding your insurance options is crucial for making the right choice.

Figuring out Rivian insurance costs can be a bit of a puzzle, but finding the perfect hotel, like the one on Flinders Street in Melbourne, hotel on flinders street melbourne , can be just as challenging! Factors like your driving history and the specific model of your Rivian electric vehicle will heavily influence the final price. Ultimately, comparing quotes from different providers is key to securing the best deal on your Rivian insurance.

This isn’t just about numbers; it’s about understanding what’s covered and what isn’t. Having the right coverage can save you a ton of headache down the road.

Standard Insurance Coverages

Standard coverage packages for Rivian vehicles usually include liability insurance. This is basically the bare minimum, protecting you from financial responsibility if you cause damage to someone else’s property or injure someone in an accident. Think of it as the fundamental safety net. Without it, you’re on your own financially.

Comparison with Optional Add-ons

Beyond the standard liability coverage, Rivian insurance often offers optional add-ons like comprehensive and collision coverage. Comprehensive coverage protects your vehicle against damage from things like hail, fire, or vandalism. Collision coverage kicks in if your Rivian gets into a crash, regardless of who’s at fault. These extras provide extra layers of protection.

Examples of Additional Coverage Options

For added peace of mind, you can consider additional coverage options. For instance, you could add roadside assistance, which can be super helpful if you get stranded or need a jump start. Other potential options include rental reimbursement, which can cover costs if your Rivian is being repaired after an accident. Think of it as having a backup plan for those unexpected hiccups.

Differences in Coverage Levels and Costs

Different coverage levels translate to different costs. A basic package with just liability insurance will be cheaper than one that includes comprehensive and collision coverage. The more protection you want, the higher the premium. It’s like choosing a meal – a basic burger is cheaper than a gourmet steak.

Coverage Packages and Associated Costs

| Coverage Package | Description | Estimated Cost (per year) |

|---|---|---|

| Basic Liability | Covers your legal obligations if you cause damage or injury to others. | Rp 2,000,000 – Rp 3,000,000 |

| Basic Liability + Comprehensive | Covers your legal obligations plus damage to your vehicle from events like theft or natural disasters. | Rp 3,500,000 – Rp 5,000,000 |

| Basic Liability + Collision + Comprehensive | Covers your legal obligations, damage to your vehicle from any accident (regardless of fault), and damage from events like theft or natural disasters. | Rp 5,000,000 – Rp 7,000,000 |

Note: These are estimated costs and may vary based on your specific location, driving history, and vehicle details. Always check with your insurance provider for accurate pricing.

How to Obtain Rivian Insurance Quotes: How Much Is Rivian Insurance Cost

Getting Rivian insurance can feel like navigating a maze, but it doesn’t have to be! Knowing the right channels and steps can save you major headaches and potentially major bucks on your premium. Let’s break down how to get those sweet, sweet Rivian insurance quotes.

Various Methods for Obtaining Quotes

Getting a quote for your Rivian ride is easier than you think. You have a plethora of options, from traditional insurance agents to super-efficient online comparison tools. Understanding these different methods empowers you to choose the approach that best suits your style and needs.

Figuring out Rivian insurance costs can be a bit of a wild ride, but trust me, it’s worth it! Fueling your adventurous spirit, you might consider how delicious your next meal will be, like these amazing meat lovers pizza tacos, a recipe you’ll love! meat lovers pizza tacos recipe The final cost of your Rivian insurance depends on various factors like your driving history and coverage options.

So, while you’re planning your next epic culinary creation, don’t forget to check the specifics for your perfect Rivian insurance fit.

Online Quote Comparison Tools

Online tools have revolutionized the insurance game, offering a super-fast and convenient way to compare quotes from multiple providers. These platforms usually ask for basic info like your driving history, vehicle details, and desired coverage, then instantly display a range of quotes. This saves you a ton of time compared to calling multiple insurance companies individually. Some popular platforms offer features like filtering results based on specific criteria, like coverage types or deductibles.

This targeted approach helps you find the best fit for your wallet and your needs.

Steps Involved in Obtaining a Quote from Different Providers

Getting a quote is a straightforward process, no matter the provider. Generally, you’ll need to provide details about your vehicle (make, model, year, VIN), your driving history (accident records, violations), and your desired coverage. Some providers might also ask about your location and other personal information. The specifics may vary, but the core information is usually consistent across insurers.

Providing Necessary Information for a Quote

Providing accurate information is key to getting an accurate quote. Be prepared to furnish details like your driving history (any accidents, violations), your vehicle’s specifics (VIN, model year), and desired coverage. Transparency is your best friend here. Being honest about your driving habits and preferences will lead to a more precise quote that fits your needs perfectly.

Comparison of Online Quote Comparison Tools

Different online quote comparison tools work slightly differently. Some might have more options for filtering results, while others might be quicker to use. Comparing the tools can reveal which best suits your style and helps you avoid any hidden fees. Research different platforms and their user reviews before choosing one to make sure you’re getting the most value.

Insurance Providers and Their Quote Procedures, How much is rivian insurance cost

| Insurance Provider | Quote Procedure |

|---|---|

| Company A | Online portal, phone call, or in-person visit. Usually requires basic information like vehicle details and driver information. |

| Company B | Mainly online, requiring vehicle details, driver information, and desired coverage level. Might use automated systems for quick responses. |

| Company C | Online portal, with a call to confirm details and finalize the quote. Emphasis on providing complete driver information and vehicle specifics. |

This table provides a snapshot of how various insurance providers handle the quote process. This overview allows you to understand the procedure each company uses, streamlining your search for the best deal.

Understanding Rivian Insurance Claims Process

Yo, peeps! Navigating insurance claims can be a total headache, especially with a fancy new Rivian. But fear not, fam! This section breaks down the Rivian insurance claim process, from start to finish, so you can handle any situation like a pro.The Rivian insurance claim process is designed to be as smooth as possible, but understanding the steps involved can save you a ton of time and stress.

Knowing the ropes beforehand will help you avoid any unnecessary drama. Let’s dive in!

Rivian Insurance Claim Process Overview

The Rivian insurance claim process typically involves several steps, starting from reporting the damage or theft to receiving the compensation. Each step is crucial for a successful claim. The faster you follow these steps, the quicker you’ll get back on the road!

Reporting the Claim

Immediately report the incident to your insurance provider. Provide as much detail as possible about the incident, including the time, location, and any witnesses. This crucial first step ensures a smooth claim process. A clear report helps your insurance provider assess the situation accurately.

Gathering Necessary Documentation

Collecting the necessary documents is key to a speedy claim. This might include the police report (if applicable), photos of the damage, repair estimates, and any other relevant information. Keep everything organized in a binder or folder so it’s easy to find when needed. The documentation ensures that your claim is processed correctly.

Evaluating the Claim

Once your insurance provider receives the claim report and documentation, they will evaluate the situation. This step involves investigating the cause of the damage or theft, verifying the details, and determining the amount of compensation. They might contact you for further information or schedule an inspection of the vehicle. This evaluation is crucial for ensuring fair compensation.

Repair or Replacement

After the claim is approved, the insurance provider will handle the repair or replacement of the damaged vehicle. They might work with approved repair shops or provide a payout for you to handle the repairs yourself. This part can vary depending on the policy and the extent of the damage.

Receiving Compensation

Finally, you’ll receive the compensation for the damages. This might involve a payout for the repair costs, a replacement vehicle, or a combination of both. Keep in mind that the payout amount is usually based on the evaluated damages. It’s a satisfying moment, getting your compensation!

Contacting the Insurance Provider

If you need assistance at any point during the claim process, contact your insurance provider directly. They can guide you through the steps, answer your questions, and provide updates on the status of your claim. Don’t hesitate to ask for help!

Claim Process Flowchart

Start --> Report Claim --> Gather Documentation --> Evaluate Claim --> Repair/Replacement --> Receive Compensation --> End

This flowchart illustrates the general steps involved in the Rivian insurance claim process. It’s a simplified representation of the actual procedure.

Tips for Minimizing Rivian Insurance Costs

Hey gengs! Rivian insurance can be a bit pricey, but there are ways to keep those premiums down. We’re diving into some seriously helpful tips to save you some serious coin. Let’s get started on making your Rivian insurance budget-friendly!

Strategies for Reducing Rivian Insurance Premiums

Insurance companies use a bunch of factors to figure out how much to charge you. Understanding these factors can help you take steps to lower your rates. It’s like playing a game of smart moves to get the best deal possible!

Factors Considered by Insurance Companies

Insurance companies carefully assess various factors when determining your premium. These factors aren’t just about your driving habits, but also about your personal details. It’s a comprehensive look at your profile to calculate the risk associated with you as a driver. Here’s a breakdown:

- Driving Record: A clean driving record is a huge plus. Zero accidents and violations will significantly lower your rates. Think of it as a gold star for being a responsible driver!

- Age and Location: Your age and location play a role in insurance premiums. Younger drivers often face higher rates due to perceived higher risk. Insurance companies often adjust rates based on the area’s accident frequency.

- Vehicle Features and Safety: Rivian vehicles are known for their advanced safety features. Insurance companies might offer discounts if your Rivian is equipped with features like advanced driver-assistance systems (ADAS).

- Usage: How often you use your Rivian impacts the premium. Frequent use often means higher exposure to risk. If you mostly use your Rivian for daily commutes, the insurance company will assess that as lower risk than someone who takes it on extended road trips.

- Claims History: Any prior insurance claims can affect your rates. Even minor accidents can lead to a rise in premiums.

Maintaining a Good Driving Record

A clean driving record is crucial for keeping your insurance costs low. This means avoiding accidents, traffic violations, and other risky driving behaviors. It’s a straightforward way to show insurance companies you’re a responsible driver. It’s like building a reputation as a reliable driver.

Safe Driving Practices

Adopting safe driving habits can contribute to lower insurance premiums. These practices include:

- Defensive Driving: Anticipating potential hazards and reacting appropriately is key to avoiding accidents. Be aware of your surroundings and drive cautiously.

- Following Traffic Laws: Adhering to speed limits, obeying traffic signals, and other rules of the road reduces the risk of accidents.

- Avoiding Distracted Driving: Putting away your phone and focusing on the road is vital for safe driving. This can significantly reduce the chance of an accident.

- Maintaining Vehicle Maintenance: Keeping your Rivian in good working order, including regular maintenance, can reduce the likelihood of mechanical issues.

Cost-Saving Strategies

Here’s a list of actionable steps you can take to minimize your Rivian insurance costs:

- Maintain a clean driving record: Avoid accidents and violations.

- Consider a higher deductible: This can lower your monthly premium but be prepared for higher out-of-pocket costs in case of an accident.

- Shop around for quotes from multiple insurance providers: Compare rates to find the best deal.

- Review your coverage options: Ensure you’re getting the right amount of coverage without overpaying.

- Take advantage of discounts: Many insurers offer discounts for safe driving, defensive driving courses, and other factors. Look for any discounts you might qualify for.

Concluding Remarks

In conclusion, understanding Rivian insurance costs requires a thorough investigation of various factors. From the different models and their associated risks to your personal driving record and location, the insurance price is a complex calculation. Armed with this knowledge, you’ll be able to confidently navigate the insurance landscape and find the best possible coverage for your Rivian vehicle.

So, go forth, compare quotes, and get the best deal possible!

Common Queries

What’s the average cost of Rivian insurance?

Unfortunately, there’s no single average. Insurance premiums depend on a multitude of factors, including the specific Rivian model, your driving history, location, and the chosen coverage options.

Do Rivian vehicles have higher insurance rates than other cars?

That depends. While Rivian vehicles might have higher premiums in certain areas or for specific models due to factors like safety features and potential accident severity, it’s not a blanket statement. Comparing similar models across different brands will give a more accurate picture.

Can I get a discount on Rivian insurance?

Absolutely! Many insurance providers offer discounts for safe drivers, accident-free records, and bundled policies. Investigating these options could save you a significant amount.

How do I file a claim for damage to my Rivian?

The claims process typically involves contacting your insurance provider, providing documentation, and following their specific procedures. Each insurance company has a slightly different process, so be sure to review the details.