Taxation of split dollar life insurance is a fascinating topic, full of potential benefits and complexities. Understanding the ins and outs of how these arrangements are taxed can save you a whole lot of headaches and possibly some serious cash. Let’s dive in and uncover the nuances of this unique financial tool!

This comprehensive guide explores the various aspects of split-dollar life insurance, from its fundamental principles to its tax implications, legal considerations, and practical applications. We’ll examine how it works, how it’s taxed, and its use in various financial scenarios, all presented in a clear and easy-to-understand way. So, get ready to unlock the secrets of this potentially lucrative financial strategy!

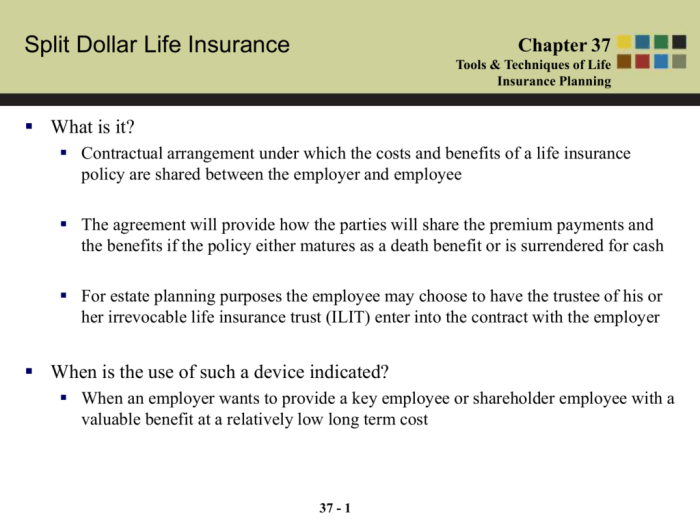

Definition and Overview

Split-dollar life insurance is a unique arrangement where the policy owner and the insured (often an employee and their employer) share the benefits and costs of a life insurance policy. It’s designed to provide a financial benefit for the insured, while offering tax advantages for both parties. This arrangement typically involves the policy owner paying a portion of the premiums, while the insured pays the rest.

The death benefit is then split between the policy owner and the insured’s beneficiaries.The fundamental principle is mutual benefit. Both parties benefit from the policy, though one often receives the insurance coverage while the other benefits from tax advantages and cost savings. The structure encourages employee retention and can provide employees with additional financial security.

Types of Split-Dollar Life Insurance Arrangements

Different types of split-dollar life insurance arrangements exist, each with its own characteristics and tax implications. These arrangements are categorized based on how premiums and benefits are split and structured.

- Single-Premium Split-Dollar Life Insurance: In this type of arrangement, the premiums are paid in a lump sum at the outset of the policy. This approach is common when the insured has a large amount of capital available or when the insured’s employer wants to make a significant contribution towards the policy’s premium. The insured may need to pay the remaining premiums.

- Level-Premium Split-Dollar Life Insurance: This approach involves the insured and the policy owner making regular premium payments over the life of the policy, often based on a predetermined schedule. This is typically more affordable for the insured, as it distributes the cost over a longer period.

- Accelerated Death Benefit Split-Dollar Life Insurance: In this variant, a portion of the death benefit is paid to the policy owner if the insured becomes terminally ill or experiences a critical illness. This helps with expenses related to the illness, and the remainder is paid to the beneficiaries.

Examples of Split-Dollar Life Insurance Structure

Imagine a scenario where a company wants to offer a benefit to its key employees. They could structure a split-dollar life insurance plan where the company pays a portion of the premium, and the employee pays the remainder. The death benefit is then divided between the company and the employee’s beneficiaries. This allows the company to provide a valuable benefit to the employee without having to bear the entire cost.Another example is a self-employed individual who wants life insurance coverage.

They can enter into a split-dollar agreement with an investment company, where the company pays part of the premiums and receives a portion of the death benefit. This reduces the individual’s out-of-pocket expense.

Comparison with Other Life Insurance Products, Taxation of split dollar life insurance

| Feature | Split-Dollar Life Insurance | Term Life Insurance | Permanent Life Insurance (e.g., Whole Life) |

|---|---|---|---|

| Premium Payment | Shared between policy owner and insured | Regular payments for a set term | Regular payments for the entire policy term or lifetime |

| Death Benefit | Split between policy owner and beneficiaries | Paid to beneficiaries upon death within the term | Paid to beneficiaries upon death |

| Cash Value | May or may not have cash value component | No cash value component | Accumulates cash value over time |

| Tax Implications | Complex, can be favorable or unfavorable depending on the specific arrangement | Premiums are generally tax-deductible | Premiums may be tax-deductible, cash value growth may be tax-deferred |

This table highlights the key distinctions between split-dollar life insurance and other traditional life insurance products. Note that the tax implications of split-dollar life insurance are intricate and vary significantly based on the specifics of the arrangement. Consulting a qualified financial advisor is crucial for understanding the implications in your particular circumstances.

Tax Implications

Split-dollar life insurance arrangements have significant tax implications for all parties involved. Understanding these implications is crucial for making informed decisions about structuring and participating in such agreements. The tax treatment varies depending on the specific roles of each participant and the terms of the agreement.The tax laws governing split-dollar life insurance are complex and can differ based on the specific circumstances.

Careful consideration of the potential tax liabilities and benefits is essential for minimizing tax burdens and maximizing potential gains.

Tax Treatment for the Policyholder

The policyholder, who owns the life insurance policy, typically does not recognize any immediate tax consequences. However, the policyholder’s tax obligations are affected by the terms of the agreement, particularly if the policyholder receives a loan or benefits from the agreement. The tax treatment of the death benefit is dependent on the circumstances and the policyholder’s status.

Tax Implications for the Premium-Paying Party

The premium-paying party, often a business or another individual, generally does not have immediate tax implications related to the premiums paid. However, the tax treatment of the premium-paying party depends on the specific structure of the agreement and their specific circumstances. Any loans or other benefits received are subject to their own set of tax rules.

Tax Implications for the Loan Recipient

The loan recipient, often an employee, typically receives a loan from the life insurance policy. The tax treatment of this loan depends on whether the loan is considered interest-free or at a below-market interest rate. If the loan is interest-free or below-market, the recipient might have to pay income tax on the imputed interest.

Tax Deductions and Credits

Some split-dollar arrangements might offer tax deductions or credits for the premium-paying party. The specific deductions or credits available are contingent on the agreement’s terms and the applicable tax laws. It is important to consult with a qualified tax advisor to determine the specific deductions or credits that may apply.

Comparison with Other Investment Strategies

Split-dollar life insurance’s tax treatment contrasts with other investment strategies. For example, investments in stocks or bonds have different tax implications concerning capital gains or dividends. The tax implications for split-dollar life insurance are unique and often depend on the specific structure of the arrangement. Understanding the differences is crucial for a thorough comparison.

Summary of Tax Implications

| Party | Tax Implications |

|---|---|

| Policyholder | Generally no immediate tax consequences, but tax treatment of death benefit depends on circumstances. |

| Premium-Paying Party | Generally no immediate tax consequences on premiums, but loans or benefits are subject to their own tax rules. |

| Loan Recipient | Imputed interest on below-market loans is taxable. |

Legal and Regulatory Considerations

Split-dollar life insurance arrangements, while offering potential tax benefits and estate planning advantages, are subject to specific legal and regulatory frameworks. Understanding these requirements is crucial for both the insured and the participants to ensure compliance and avoid potential complications. Navigating these regulations is vital to maintain the integrity and enforceability of the agreement.

Legal Requirements Governing Split-Dollar Agreements

The legal requirements for split-dollar life insurance arrangements vary depending on the jurisdiction and the specific structure of the agreement. These requirements often involve the documentation of the agreement, the roles of the parties involved, and the financial reporting obligations. Compliance with these requirements is critical to ensure the agreement’s validity and prevent disputes.

Taxation of split dollar life insurance can get pretty complicated, right? Like, trying to figure out how much you owe on a massive pizza order. It’s all about how the whole thing is structured, and it can be a right pain. You’ve gotta be on the ball, though, ’cause it’s all about the dough, just like when you’re making a pizza with store bought dough making a pizza with store bought dough.

Ultimately, it all boils down to the same principle: understanding the tax implications is crucial, no matter what.

Key Legal Considerations in Structuring Split-Dollar Agreements

Several key legal considerations must be addressed when establishing a split-dollar agreement. These include ensuring that the agreement is clearly defined, outlining the rights and responsibilities of each party, and specifying the terms for premium payments, death benefits, and other financial obligations. Properly documenting these considerations is crucial to prevent misunderstandings and future conflicts.

Role of Insurance Companies in Split-Dollar Transactions

Insurance companies play a critical role in split-dollar transactions. They are responsible for issuing and administering the life insurance policy, adhering to the terms Artikeld in the split-dollar agreement. They act as a neutral party, ensuring the agreement’s compliance with insurance regulations. Their role involves handling policy changes, premium payments, and death benefit payouts according to the agreement’s stipulations.

Regulatory Frameworks and Guidelines for Split-Dollar Agreements

Various regulatory frameworks and guidelines govern split-dollar agreements. These guidelines aim to prevent the misuse of life insurance policies for tax avoidance or other illicit activities. These regulations often require the disclosure of the split-dollar agreement’s terms and conditions to the insurance company and relevant tax authorities.

Steps Involved in Establishing a Compliant Split-Dollar Arrangement

Establishing a compliant split-dollar arrangement requires careful consideration and adherence to several steps. These steps typically involve: 1) Determining the objectives and needs of the parties; 2) Drafting a comprehensive agreement outlining the terms and conditions; 3) Obtaining appropriate legal counsel to ensure compliance with all applicable laws; 4) Securing the necessary approvals and signatures; and 5) Regularly reviewing and updating the agreement as needed.

Table of Legal and Regulatory Implications for Various Split-Dollar Scenarios

This table Artikels the legal and regulatory implications for various split-dollar scenarios, highlighting the potential complexities and considerations for each.

| Split-Dollar Scenario | Legal and Regulatory Implications |

|---|---|

| Scenario 1: Employee-Employer Split-Dollar | The agreement must be structured to comply with IRS regulations regarding compensation and benefits, and may require specific reporting to the IRS. The agreement should be transparent and clearly document the parties’ rights and obligations. |

| Scenario 2: Investor-Beneficiary Split-Dollar | The agreement should clearly delineate the roles and responsibilities of the investor and beneficiary. The agreement needs to comply with state and federal laws regarding investments and the transfer of assets. Documentation of the agreement and all financial transactions is paramount. |

| Scenario 3: Family-Owned Business Split-Dollar | This structure is often subject to complex estate tax and business valuation rules. The agreement should be structured to minimize tax implications and ensure the smooth transfer of ownership. Legal advice should be sought to address specific tax and estate planning considerations. |

Practical Applications and Strategies

Split-dollar life insurance offers a versatile approach to financial planning, blending life insurance benefits with tax advantages. Understanding its diverse applications, potential benefits, and associated risks is crucial for informed decision-making. This section explores common uses, estate planning strategies, and methods for achieving specific financial goals.Employing split-dollar life insurance can be tailored to meet individual financial circumstances. It can serve as a tool for wealth accumulation, estate transfer, and achieving specific financial objectives.

However, careful consideration of potential drawbacks and mitigation strategies is essential.

Common Uses in Various Financial Scenarios

Split-dollar life insurance arrangements are not limited to a single application. They can be adapted to a range of financial situations, from business succession planning to personal wealth accumulation. The flexibility in structuring the agreement allows for diverse implementations.

- Business Succession Planning: A business owner can use split-dollar life insurance to provide funds for the buyout of their shares by their family or employees, ensuring a smooth transition. This can be a crucial aspect of a succession plan.

- Key Employee Retention: Companies may use split-dollar arrangements to incentivize and retain key employees. The life insurance policy’s death benefit can be used to fund a buyout of the employee’s shares or provide a substantial lump-sum payment to their beneficiaries. This can be a valuable incentive for highly skilled or essential employees.

- Funding Education or Other Goals: Individuals can use split-dollar life insurance to secure funding for their children’s education or other future goals. The death benefit can be leveraged to meet these specific objectives, providing a significant financial cushion.

Estate Planning Applications

Split-dollar life insurance can be a valuable tool for estate planning. It can help reduce estate taxes, enhance wealth transfer, and provide a structured approach to managing assets.

- Tax Optimization: The tax-advantaged nature of split-dollar life insurance can be used to reduce the estate tax burden. By structuring the agreement carefully, the policy’s death benefit can be allocated in a way that minimizes the impact of estate taxes.

- Wealth Transfer Strategies: The flexibility of split-dollar life insurance allows for various wealth transfer strategies. It can be structured to provide for the needs of beneficiaries, while also potentially minimizing tax implications.

- Minimizing Gift Tax: The premiums paid by the beneficiary can be viewed as gifts, potentially subject to gift tax rules. The structure of the agreement can help minimize the impact of these taxes.

Achieving Specific Financial Goals

Split-dollar life insurance can be used to achieve a wide range of financial goals, from funding business operations to providing financial security for dependents. The policy’s features can be adapted to various circumstances.

- Retirement Planning: The death benefit of a split-dollar life insurance policy can be used as a source of funding for retirement. The premiums can be structured in a way that aligns with the individual’s retirement goals.

- Funding Charitable Giving: The policy can be structured to allow for the transfer of funds to charitable causes. This approach provides a vehicle for supporting organizations that align with an individual’s values.

- Business Funding: The policy’s death benefit can be used to provide funding for a business. This can be particularly useful in situations where a business owner needs additional capital.

Illustration of Various Scenarios

The following table provides illustrative examples of how split-dollar life insurance can be applied in different scenarios. Note that these are simplified examples and specific situations may require adjustments based on individual circumstances.

| Scenario | Description | Potential Benefits |

|---|---|---|

| Business Succession | A business owner uses split-dollar to fund the buyout of their shares by their children. | Facilitates a smooth transition, minimizes disruption, and provides a predictable payout. |

| Employee Retention | A company uses split-dollar to reward a key employee, increasing their incentive to stay. | Incentivizes key employees, improving retention, and potentially reducing employee turnover. |

| Education Funding | Parents use split-dollar to secure funds for their children’s future education. | Provides a reliable source of funds for educational expenses, potentially minimizing the need for other funding sources. |

Potential Risks and Drawbacks

Split-dollar arrangements, while offering potential advantages, are not without potential risks. Carefully evaluating these factors is critical.

- Complexity of Agreements: Split-dollar agreements can be complex, potentially requiring specialized legal expertise. This complexity can lead to misunderstandings or unintended consequences.

- Potential Tax Implications: The tax implications of split-dollar arrangements can be complex and vary depending on the specific structure of the agreement. Carefully analyzing these implications is essential.

- Administrative Burden: Maintaining the records and administrative tasks associated with split-dollar arrangements can be time-consuming and burdensome.

Mitigation Strategies

Several strategies can mitigate the risks associated with split-dollar life insurance.

- Professional Advice: Consulting with experienced financial advisors, estate planners, and tax professionals is crucial for navigating the complexities of split-dollar arrangements.

- Detailed Documentation: Maintaining meticulous records of all transactions, agreements, and communications related to the split-dollar arrangement is vital for clarity and accountability.

- Regular Review and Adjustments: Periodically reviewing the split-dollar arrangement to ensure it continues to align with the evolving needs and goals of the parties involved is crucial.

Illustrative Case Studies

Split-dollar life insurance arrangements, while offering numerous benefits, require careful planning and execution. Understanding successful implementations and potential pitfalls through case studies is crucial for navigating the complexities of this strategy. These case studies illustrate how these arrangements can be structured effectively, considering tax implications and financial outcomes for all parties involved.

Successful Split-Dollar Arrangement Case Study

This case study details a successful split-dollar arrangement between a business owner (Mr. Smith) and a financial advisor (Ms. Jones). Mr. Smith, a 45-year-old entrepreneur, desired to secure his business’s future and build wealth.

Ms. Jones recommended a split-dollar life insurance policy to meet both objectives.

- Policy Structure: The policy was structured with Mr. Smith as the insured and the business as the beneficiary. The premium payments were shared proportionally between Mr. Smith and the business, with the business paying a significant portion. The death benefit was structured to provide a substantial payout to the business.

- Implementation Steps: Ms. Jones meticulously guided Mr. Smith through the selection of the appropriate policy, premium allocation, and benefit distribution. She also advised on estate planning considerations, ensuring a seamless transition in case of Mr. Smith’s passing.

- Financial Outcomes: The policy provided significant tax benefits for Mr. Smith, and the business secured a substantial death benefit. Mr. Smith enjoyed a tax-advantaged growth component in the policy, while the business enjoyed the tax benefits of using the policy as an investment.

Case Study Highlighting Potential Challenges and Solutions

While split-dollar arrangements can be beneficial, they can also present challenges. This case study highlights a potential issue and its resolution.

Taxation of split-dollar life insurance can be a right pain, tbh. Like, it’s all about how the premiums and benefits are taxed, right? Apparently, it’s all linked to the whole Olivia Rodrigo tour san francisco thing olivia rodrigo tour san francisco , which is, like, huge right now. But, seriously, the tax implications are seriously complex, especially for, like, high-value policies.

It’s all a bit of a head-scratcher, innit?

- Challenge: A 35-year-old professional, Ms. Brown, was in a split-dollar arrangement with a high-net-worth individual (Mr. Davis). Ms. Brown’s income fluctuated, making it difficult to consistently meet her premium obligations.

- Solution: Ms. Brown and Mr. Davis revised the agreement, exploring options like a loan against the policy or adjusting the premium structure based on Ms. Brown’s income projections. They also explored alternative funding strategies, allowing for flexibility and ensuring the agreement remained viable for both parties.

Mitigating Tax Implications

Understanding and managing the tax implications of split-dollar arrangements is crucial.

- Strategies: Employing a well-structured arrangement, ensuring accurate record-keeping, and consulting with tax professionals can help mitigate potential tax liabilities. Careful consideration of the specific tax laws in each jurisdiction is essential.

- Example: In cases where the policy’s cash value grows substantially, understanding the implications for taxation on the growth component is crucial.

Key Takeaways

| Case Study | Key Takeaway |

|---|---|

| Successful Arrangement | Careful planning, clear communication, and professional guidance are essential for successful implementation. |

| Potential Challenges | Flexibility and adaptability in the arrangement are key to overcoming unforeseen circumstances. |

| Tax Mitigation | Proactive tax planning and consulting with qualified professionals are critical to minimize tax liabilities. |

Specific Considerations for Different Parties

Split-dollar life insurance arrangements involve multiple parties with distinct interests and potential tax implications. Understanding the considerations for each party is crucial for structuring a beneficial and compliant agreement. Proper planning can mitigate potential tax burdens and ensure all parties understand their rights and responsibilities.Careful consideration of the unique needs and potential challenges of each party is essential for successful implementation and long-term satisfaction.

This section will Artikel the specific considerations for the insured, the premium-paying party, and the loan recipient.

Considerations for the Insured

The insured in a split-dollar arrangement benefits from a loan with potentially favorable terms, while maintaining ownership and control of the life insurance policy. Crucially, they should ensure the agreement aligns with their financial goals and estate planning strategies. The insured should understand the implications of the arrangement on their overall financial picture and seek professional guidance if needed.

Considerations for the Premium-Paying Party

The premium-paying party in a split-dollar arrangement often has a financial incentive, such as tax deductions or investment returns. They should thoroughly review the agreement, ensuring it aligns with their investment objectives and tax strategies. The potential tax benefits and associated liabilities should be clearly understood and compared with alternative investment opportunities.

Considerations for the Loan Recipient

The loan recipient benefits from a potentially lower interest rate than traditional financing. They should carefully review the terms of the agreement, including repayment schedules and potential penalties for non-compliance. The recipient should seek independent financial advice to assess the overall cost and benefit of the split-dollar loan in relation to other financing options.

Table of Specific Needs and Considerations

| Party | Primary Needs | Considerations |

|---|---|---|

| Insured | Favorable loan terms, maintaining policy ownership, aligning with financial goals | Understanding tax implications, estate planning implications, professional guidance |

| Premium-Paying Party | Tax deductions or investment returns, aligning with investment objectives | Thorough review of the agreement, understanding tax benefits/liabilities, comparing with alternative investments |

| Loan Recipient | Potentially lower interest rate, clear repayment schedule, understanding potential penalties | Independent financial advice, overall cost-benefit analysis, alternative financing options |

Potential Conflicts of Interest

Conflicts of interest can arise in split-dollar transactions if the parties involved have competing interests. For example, if the premium-paying party also acts as the loan recipient or has an incentive to structure the agreement in a way that benefits them disproportionately, a conflict may exist. The complexity of the arrangement and the potential for misaligned interests highlight the importance of transparent and clearly defined agreements.

Avoiding Potential Conflicts in Split-Dollar Agreements

Clearly defined roles and responsibilities are crucial for avoiding conflicts of interest. Professional advice from qualified advisors for all parties involved is strongly recommended. Explicitly outlining the terms and conditions, including the payment schedule, interest rates, and any potential penalties for non-compliance, is vital for transparency. The agreement should be reviewed by independent legal and financial professionals to ensure fairness and compliance.

Concluding Remarks: Taxation Of Split Dollar Life Insurance

In conclusion, navigating the world of split-dollar life insurance taxation requires a careful consideration of the different parties involved, the potential tax implications, and the specific legal requirements. Understanding the potential benefits and risks is crucial for making informed decisions. This guide has provided a thorough overview of this complex financial tool, offering a framework for you to apply these insights to your specific situation.

Hopefully, you now have a clearer picture of how split-dollar life insurance taxation impacts your financial journey. Happy planning!

Question & Answer Hub

What are some common uses of split-dollar life insurance?

Split-dollar life insurance can be used for estate planning, funding business buy-sell agreements, or even as a way to accumulate wealth over time. It’s often used in situations where a specific financial goal is desired.

How does the tax treatment differ for the policyholder, premium-paying party, and loan recipient?

The tax implications vary depending on the role each party plays in the split-dollar agreement. The policyholder may face tax implications related to the death benefit, while the premium-paying party might have deductions related to the premiums paid. The loan recipient may have tax obligations on any loan proceeds received.

Are there any potential conflicts of interest in split-dollar transactions?

Yes, conflicts of interest can arise when parties have competing financial interests. It’s important to ensure transparency and clearly defined roles to minimize such conflicts.

What are some strategies to mitigate the risks of split-dollar arrangements?

Careful planning, thorough documentation, and seeking professional advice are key strategies to mitigate potential risks. A clear understanding of the legal and tax implications is essential.